SOURCE:State Taxation AdministrationPUBDATE:2025-06-05

1. Departure Tax Refund Policy

Overseas visitors can be refunded value-added tax (VAT) for the tax-refundable goods they purchase at tax-free stores when they leave China from ports of departure.

Overseas visitors who purchase tax-refundable goods at tax-free stores that provide the “refund-upon-purchase” service can claim tax refunds on-site at the stores after signing an agreement and completing a credit card pre-authorization. In addition to complying with existing regulations on the departure tax refund, overseas visitors enjoying the “refund-upon-purchase” service shall also meet the following conditions at the same time:

(1) Overseas visitors hold a credit card of his/her own with an operational pre-authorization guarantee;

(2) Overseas visitors promise to leave China within the prescribed time limit and from the designated ports.

Overseas visitors refer to foreigners and compatriots from Hong Kong, Macau and Taiwan Regions of China who reside in China’s mainland for no more than 183 consecutive days before the date of departure.

Ports of departure refer to ports in regions where the departure tax refund policy is implemented, which are officially open to the public and within which tax refund agencies are established, including air transport ports, water ports and land ports.

2. Eligible Goods

Goods eligible for VAT refund are goods for personal use that are purchased by overseas visitors at tax-free stores and meet certain conditions. The following items are excluded:

(1) Goods listed in the Catalog of Items Prohibited and Restricted from Entering and Exiting the People’s Republic of China:

a. Exit Prohibited Items:

(a) All the entry prohibited items;

(b) Manuscripts, printed materials, films, photos, records, audio tapes, VCDs, laser videodiscs, computer storage media and other items containing state secrets;

(c) Precious cultural relics and other exit prohibited cultural relics; and

(d) Rare and endangered animals and/or plants, including their specimens, seeds and propagation materials.

b. Exit Restricted Items:

(a) Precious metals such as gold, silver, and products made from gold or silver;

(b) National currencies;

(c) Foreign currencies and the relevant marketable securities;

(d) Radio transceivers and communication security machines;

(e) Precious traditional Chinese medicines;

(f) Ordinary cultural relics; and

(g) Other exit restricted items specified by the customs.

(2) VAT exempt goods sold at tax-free stores;

(3) Other goods as prescribed by the Ministry of Finance, the General Administration of Customs and the State Taxation Administration.

3. Conditions

Visitors who apply for VAT refund shall meet all the conditions as listed below:

(1) The amount of tax-refundable goods purchased by the same overseas visitor at the same tax-free store within the same day reaches 200 Chinese yuan (CNY);

(2) Tax-refundable goods have not yet been used or consumed;

(3) The departure date is no more than 90 days from the date of the purchase of tax-refundable goods;

(4) The tax-refundable goods purchased shall be carried with the overseas visitor himself/herself, or checked as his/her luggage upon departure.

4. Amount of Tax Refund

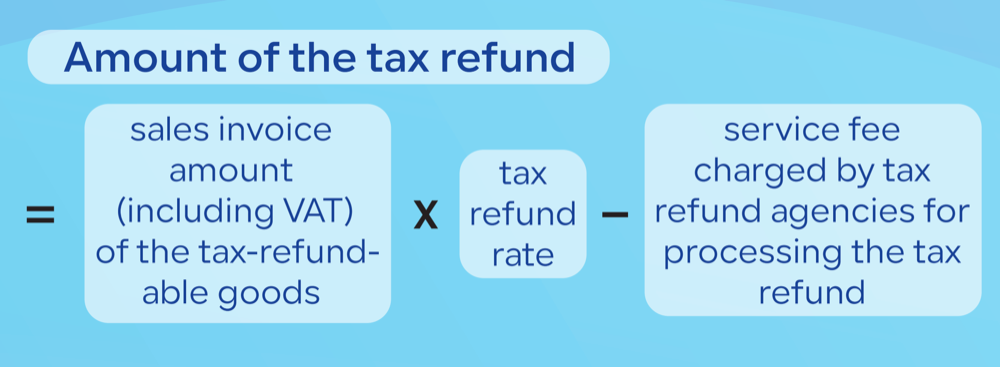

From April 1, 2019, the calculation of VAT refundable shall be based on the invoice amount (including VAT) of tax-refundable goods. For items with the applicable tax rate of 13%, the tax refund rate is 11%. For items with the applicable tax rate of 9%, the tax refund rate is 8%. The calculation formula is as follows:

5. Currency for Tax Refund

The currency for the tax refund is renminbi (RMB). Tax refunds can be paid either in cash or through bank transfer. If the amount of the tax refund is no more than 20,000 Chinese yuan (CNY), either of the two tax refund methods may be chosen. If the amount of the tax refund exceeds 20,000 Chinese yuan (CNY), the tax refund shall be made through bank transfer.

6. Process

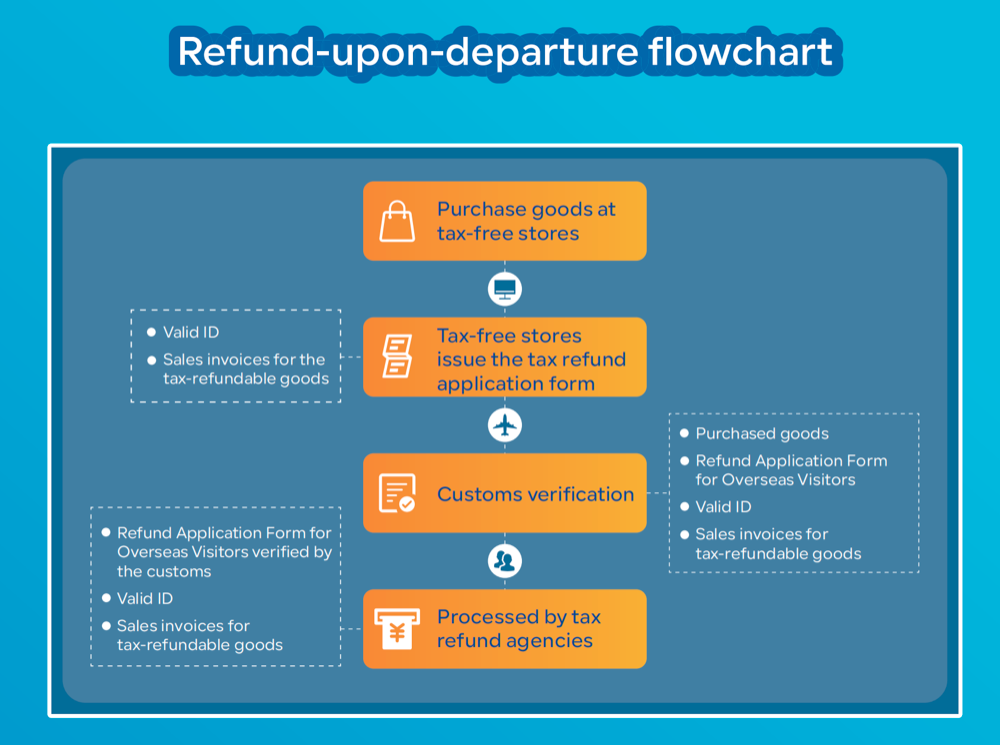

(1) Refund-upon-departure process

a. Purchasing tax-refundable goods: Overseas visitors who apply for the departure tax refund after purchasing tax-refundable goods at tax-free stores shall ask for the Refund Application Form for Overseas Visitors and sales invoices from the tax-free stores.

b. Customs verification: Overseas visitors shall declare their purchases at the port of departure together with the Refund Application Form for Overseas Visitors, the sales invoices, and their valid ID to the Chinese customs for verification. The customs shall sign and seal the Form after confirming that there is no error.

Valid ID mentioned above shall refer to passports, Mainland Travel Permit for Hong Kong and Macau residents, Mainland Travel Permit for Taiwan residents, etc., which indicate or can record the last entry date of overseas visitors.

c. Refunding by agencies: The departure tax refund shall be processed by tax refund agencies established within the restricted zone at the port of departure. Overseas visitors shall apply for the VAT refund to the aforementioned agencies with their valid ID, the Refund Application Form for Overseas Visitors signed and sealed by the customs, and the sales invoices for the purchased goods.

(2) Refund-upon-purchase process

a. Purchasing tax-refundable goods: Overseas visitors who apply for the departure tax refund after purchasing tax-refundable goods at tax-free stores providing the “refund-upon-purchase” service shall ask for the Refund Application Form for Overseas Visitors and the sales invoices from the tax-free stores.

b. Pre-authorization guarantee: Overseas visitors, when applying for the “refund-upon-purchase” service, shall provide a credit card for pre-authorization guarantee, sign the informed consent form, and receive an advance payment equivalent to the amount of the tax refund.

c. Customs verification: Overseas visitors shall declare their purchases at the port of departure together with the Refund Application Form for Overseas Visitors, the sales invoices, and their valid ID to the Chinese customs for verification. The customs shall sign and seal the Form after confirming that there is no error.

d. Review by tax refund agencies: Overseas visitors shall submit their valid ID, the Refund Application Form for Overseas Visitors signed and sealed by the customs, and the sales invoices for the purchased goods to tax refund agencies established within the restricted zone at the port of departure for review.

Where there is no error after the review, the pre-authorization guarantee shall be removed. Where the tax refund claim does not comply with relevant regulations, the tax refund agencies shall recover the advance payment through the pre-authorization guarantee.

7.Flowcharts

Telephone 0755-27617814Email liccsz@163.com

Telephone 0755-27617814Email liccsz@163.com

Address 4 / F, Tower B, OCT Central One, Mintang Road, Longhua District, Shenzhen

Opening Hours 9:00 a.m. - 12:00 p.m., 2:00 p.m. - 6:00 p.m. Monday to Friday (excluding statutory holidays)